The smart Trick of Business Owner's Policy (BOP): What It Is, How to Get One That Nobody is Talking About

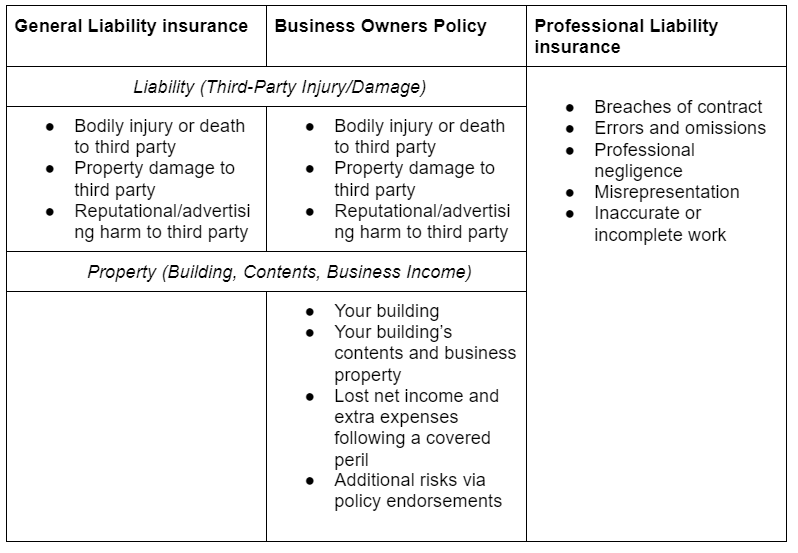

This mix offers you both liability security - for things like mishaps and claims - and commercial residential or commercial property insurance, which covers your structure and business personal effects. Service individual home is coverage for residential or commercial property owned and used by your service. It's a protection included in an entrepreneur policy. A business owners policy covers liability claims, like customer injury and residential or commercial property damage not owned by the company, in addition to securing your industrial building and its contents.

General liability protects your organization from third-party liability claims, including bodily injury, residential or commercial property damage and accident. There's no requirement for an extra general liability insurance coverage policy if you have a BOP. Yes. Progressive can help you get business insurance coverage, including an entrepreneur policy (BOP), in all states other than Hawaii.

Insurer selling service insurance deal policies that combine protection from all significant residential or commercial property and liability risks in one bundle. (They likewise sell coverages separately.) One package acquired by small and mid-sized services is the businessowners policy (BOP). Package policies are produced for businesses that normally face the exact same kind and degree of threat.

All About Business Owners Policy (BOP) - Orlando FL & Longwood FL

BOPs include Home insurance for buildings and contents owned by the company-- there are two various forms, basic and special, which supplies more thorough coverage. https://pbibins.com/fire-protection/ , which covers the loss of earnings arising from a fire or other catastrophe that disrupts the operation of the service. It can also include the additional expense of running out of a temporary place.

This harm is an outcome of things that you and your staff members do or fail to do in your service operations that might trigger physical injury or residential or commercial property damage due to malfunctioning products, malfunctioning installations and mistakes in services provided. BOPs do NOT cover professional liability, automobile insurance, worker's payment or health and special needs insurance.